Introduction:

The recent closure of Silicon Valley Bank (SVB) by the Federal Deposit Insurance Corporation (FDIC) has highlighted the importance of interest rate risk management and asset liability management for banks. This tragic event was not caused by a single bad decision but by a series of poor choices and negligence over a few quarters. In this paper, we will examine the facts surrounding SVB’s closure and explain the critical role of interest rate risk management and asset liability management in avoiding similar catastrophic events.

Facts:

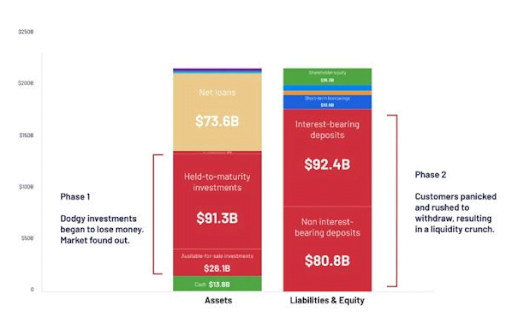

SVB’s portfolio consisted of 55% securities, more than any other major bank. Nearly half of those securities (47%) were long-dated (5+ yrs), also more than any other major bank. Furthermore, 97% of SVB accounts held more than $250K, a higher percentage than all but BNY Mellon.

Asset Liability Mismatch:

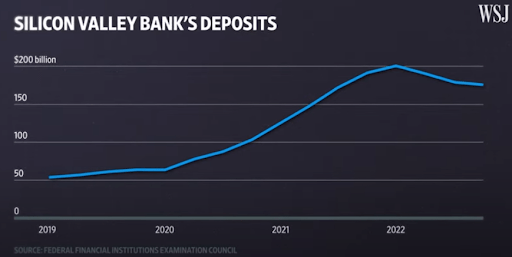

The abundance of capital and funding over the past years meant that start-ups had more money to deposit than to borrow. At the end of 2022, SVB had $173.1bn in deposits and only $74.3bn in loans.

Source Credits: Wall Street Journal

Given that banks make money on the difference between the interest rate they pay to depositors vs. the one they receive from borrowers, SVB needed to do something to close the gap. They chose to invest in long-term T-bills. However, this strategy created a short-term asset liability mismatch within the bank, as shown in the following diagram.

Source Credits: LinkedIn

Interest Rate Risk:

A significant portion of the depositor money was invested in long-term T-bills, which are more prone to interest rate increase risk rather than short-term T-bills. When the Federal Reserve began increasing interest rates, the value of these bonds decreased because investors had an instrument that yielded higher returns than those bonds. This would not have been a problem as long as they did not have to sell these bonds.

Source Credits: Wall Street Journal

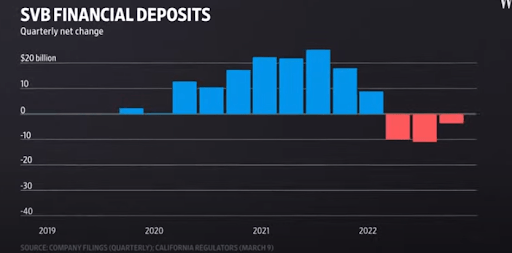

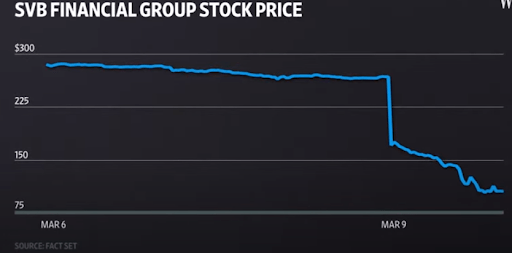

However, the withdrawal rate suddenly shot up due to an economic slowdown and the emergence of higher returns in the debt market. Due to their poor liquidity, SVB was not in a position to meet this demand and had to sell those bonds at a loss of $1.8B to meet the withdrawal demands. This amount was not enough, and they decided to generate some more capital by selling equity, which was the final nail in the coffin. When this news hit the market, there was chaos among investors, and SVB’s stock prices tanked by almost 60%.

Source Credits: Wall Street Journal

Aftermath:

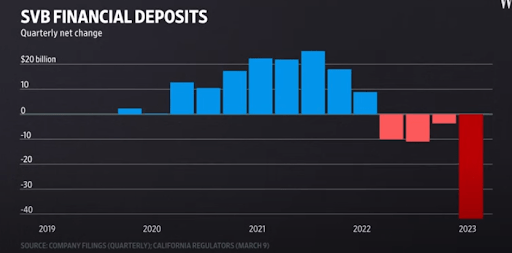

Source Credits: Wall Street Journal

As stock prices dropped, customers panicked and tried withdrawing their deposits, totaling $40B. The bank couldn’t cope, prompting the FDIC to shut it down.

Conclusion:

The SVB case highlights the importance of managing interest rate and asset-liability risks to avoid disasters. Banks must ensure that they manage their assets and liabilities correctly to avoid any mismatches that can lead to losses. Additionally, banks should ensure they have enough liquidity to meet obligations during sudden withdrawal demands. They also have short-term T-bills and interest rate swaps in their portfolio. By following these principles, banks can protect themselves and their customers from interest rate risks and asset-liability mismatches.