The banking industry is experiencing a significant transformation with the integration of AI in risk and compliance. As financial institutions face increasingly complex regulatory environments and evolving risk landscapes, Generative AI (GenAI) emerges as a game-changing technology. This powerful tool has the potential to revolutionize how banks manage risk, ensure compliance, and streamline their operations in an ever-changing financial world.

GenAI for banks offers a wide range of applications, from enhancing fraud detection to improving regulatory reporting. This article explores the promise of Generative AI in banking risk management, delves into key use cases, and discusses strategies to implement GenAI effectively. By harnessing the power of this cutting-edge technology, financial institutions can boost their risk assessment capabilities, strengthen their compliance frameworks, and ultimately gain a competitive edge in the dynamic banking sector.

The Promise of Generative AI in Banking Risk Management

Generative AI (GenAI) is at the forefront of transforming risk management in financial institutions. This powerful technology has the potential to revolutionize how banks handle risk assessment, compliance, and decision-making processes. By harnessing the capabilities of GenAI, banks can enhance their efficiency, accuracy, and predictive capabilities in managing various types of risks.

Shift from Task-Oriented to Strategic Risk Prevention

One of the most significant promises of GenAI in banking risk management is the shift from task-oriented activities to strategic risk prevention. This technology enables risk functions to transition towards a more proactive approach, fostering collaboration with different business lines. By automating traditional underwriting models, collection processes, and monitoring systems, GenAI enhances the efficiency and accuracy of risk management practices.

This shift allows banks to focus on preventing risks before they materialize, rather than simply reacting to them. For instance, GenAI algorithms can analyze vast amounts of data to identify patterns and predict potential risks more accurately than traditional models. This predictive capability enables banks to take proactive measures to mitigate risks, leading to better decision-making and reduced operational costs.

Creation of AI-Powered Risk Intelligence Centers

Financial institutions are exploring the establishment of AI- and GenAI-powered risk intelligence centers. These centers serve as hubs for automated reporting, improved risk transparency, and more efficient decision-making processes. By leveraging GenAI capabilities, these centers can provide tailored insights and recommendations, driving proactive risk management strategies.

In this scenario, a GenAI-powered risk intelligence center could analyze market trends, regulatory changes, and customer behavior in real-time. This analysis enables agile decision-making and risk mitigation strategies. For example, the center could automatically flag potential regulatory violations, reducing the time required for manual review and ensuring compliance with ever-changing regulations.

Virtual Experts for Policy and Regulatory Guidance

GenAI has the potential to create virtual experts that can provide guidance on policies and regulations. These AI-powered virtual experts can assist banks in navigating the complex landscape of financial regulations and internal policies. By analyzing vast amounts of regulatory documents and internal guidelines, GenAI can offer accurate and up-to-date advice on compliance matters.

These virtual experts can help banks in several ways:

- Automating compliance monitoring: GenAI algorithms can continuously monitor transactions and operations to ensure they comply with relevant regulations.

- Generating regulatory reports: AI systems can automatically generate reports and documentation required by various regulatory bodies, reducing manual effort and the risk of errors.

- Tracking regulatory changes: GenAI can be trained to monitor changes in legislation and formal rules, helping banks adjust their compliance strategies in real-time.

- Enhancing fraud detection: By integrating GenAI into their compliance systems, financial institutions can improve their ability to detect and prevent fraud, a critical aspect of regulatory compliance.

The promise of GenAI in banking risk management extends across various functions, including regulatory compliance, financial crime detection, credit risk assessment, modeling and data analytics, cyber risk management, and climate risk evaluation. By generating insights from vast amounts of data, GenAI enhances risk detection, improves decision-making processes, and ensures compliance with regulatory requirements.

However, it’s important to note that while the rewards of AI are significant, banks must prioritize data integrity and security to uphold customer trust and comply with regulations. As financial institutions continue to implement GenAI, they need to develop and execute effective strategies based on data sensitivity, operational risk, governance best practices, and regulatory requirements.

Key Applications of GenAI in Risk and Compliance

Regulatory Compliance Automation

Generative AI (GenAI) has a significant impact on regulatory compliance in the banking sector. It can act as a virtual expert, offering guidance on policies and regulations. This AI-powered system can analyze vast amounts of regulatory documents and internal guidelines, providing accurate and up-to-date advice on compliance matters. GenAI can automate compliance monitoring, continuously checking transactions and operations to ensure they align with relevant regulations.

One of the key advantages of GenAI in regulatory compliance is its ability to generate regulatory reports automatically. This feature reduces manual effort and minimizes the risk of errors in documentation required by various regulatory bodies. Moreover, GenAI can track regulatory changes in real-time, helping banks adjust their compliance strategies promptly.

By leveraging GenAI, financial institutions can streamline their compliance workflows, saving time and improving overall efficiency. The technology can compare policies, regulations, and operating procedures, flagging potential breaches and policy violations. This proactive approach to compliance management helps banks stay ahead of regulatory requirements and mitigate risks effectively.

Financial Crime Detection and Prevention

GenAI has revolutionized the way banks detect and prevent financial crimes. Traditional fraud detection systems often rely on predetermined rules and patterns, which can become outdated as fraudsters adapt their tactics. GenAI, however, can analyze extensive bank data and recognize subtle irregularities that rule-based systems might miss.

In the realm of anti-money laundering (AML) and fraud prevention, GenAI demonstrates remarkable capabilities. It can generate suspicious activity reports based on customer and transaction information, automating the creation and update of customers’ risk ratings. By analyzing transaction data, GenAI can identify patterns associated with money laundering and other illegal activities, staying ahead of evolving criminal methods.

The adaptability of GenAI ensures that banks remain at the forefront of identifying and stopping fraudulent activities. It can detect early warning signals by analyzing real-time transaction data and comparing it with historical records, alerting risk monitoring operations about deviations and potential fraud patterns. This proactive approach to financial crime detection significantly enhances a bank’s ability to prevent illicit activities.

Credit, Cyber, and Climate Risk Assessment

GenAI has a transformative impact on various risk assessment areas in banking, including credit, cyber, and climate risks. In credit risk assessment, GenAI can analyze transaction data, customer behavior, market trends, and economic indicators to evaluate risks more accurately. By continuously learning from new data, these AI systems can enhance their predictive models, offering banks more precise risk assessments.

In the realm of cybersecurity, GenAI plays a crucial role in analyzing network traffic, detecting unusual activity, and forecasting potential cyber-attacks. By issuing early warnings about cyber threats, AI assists banks in fortifying their defenses and responding promptly to breaches. GenAI can be trained on cybersecurity intelligence datasets, encompassing attack patterns, potential risks, and vulnerabilities, to scrutinize network traffic, historical patterns, system logs, and real-time events.

Climate risk assessment has become increasingly important for banks, and GenAI offers innovative solutions in this area. It can model the impact of climate change on various assets, enabling banks to evaluate their exposure to climate-related risks. GenAI assists in integrating climate risks into credit rating and loan underwriting processes, creating customer-specific climate risk scores and facilitating proactive climate risk modeling.

By leveraging GenAI in these key applications, banks can enhance their risk and compliance management capabilities, staying ahead of evolving threats and regulatory requirements. The technology’s ability to process vast amounts of data, identify patterns, and provide real-time insights makes it an invaluable tool in the modern banking landscape.

Implementing GenAI: Strategies and Considerations

Prioritizing Use Cases

To effectively implement Generative AI (GenAI) in banking risk and compliance, financial institutions need to prioritize use cases that align with their strategic objectives. Banks should focus on identifying high-value opportunities that can drive productivity and enhance risk management capabilities. By assessing the potential impact, associated risks, and feasibility of each use case, organizations can make informed decisions about where to invest their resources.

One approach to prioritization is to start with three to five high-priority risk and compliance use cases that can be executed within a three to six-month timeframe. This focused strategy allows banks to quickly demonstrate the value of GenAI while building internal expertise and confidence in the technology. Some promising use cases include automating regulatory compliance processes, enhancing fraud detection and prevention, and improving anti-money laundering (AML) operations.

Developing a GenAI Ecosystem

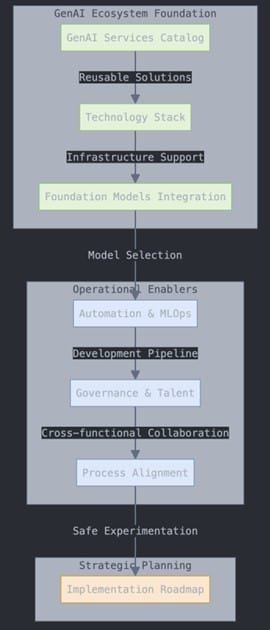

To scale GenAI applications effectively, financial institutions need to develop a comprehensive ecosystem that supports the technology’s implementation and growth. This ecosystem should encompass several key components:

- A catalog of production-ready, reusable GenAI services and solutions that can be easily integrated into various business scenarios across the banking value chain.

- A secure, GenAI-ready technology stack that supports hybrid-cloud deployments and enables the handling of unstructured data, vector embedding, and machine learning operations.

- Integration with enterprise-grade foundation models and tools to enable fit-for-purpose selection and orchestration across open and proprietary models.

- Automation of supporting tools, including MLOps (machine learning operations), data, and processing pipelines, to accelerate the development, release, and maintenance of GenAI solutions.

- Governance and talent models that facilitate cross-functional collaboration and knowledge exchange among experts in language processing, AI product development, and legal and regulatory compliance.

- Process alignment for building GenAI to support rapid and safe end-to-end experimentation, validation, and deployment of solutions.

- A roadmap detailing the timeline for launching and scaling various capabilities and solutions, aligned with the organization’s broader business strategy.

Managing Associated Risks

While GenAI offers significant potential benefits, it also introduces new risks that banks need to address and manage responsibly. To ensure the safe and effective use of GenAI in risk and compliance functions, financial institutions should consider the following strategies:

- Develop a robust AI governance framework: Establish clear policies and guidelines for the use of GenAI, addressing issues such as data privacy, regulatory compliance, and risk tolerance. This framework should be tailored to the specific needs and risk profile of the organization.

- Implement strong controls and oversight: Ensure that appropriate controls are in place to monitor and validate the outputs of GenAI models. This may include human-in-the-loop reviews for critical applications and real-time guardrails for customer-facing solutions.

- Address data security and privacy concerns: Implement measures to protect sensitive data used in GenAI models and ensure compliance with data privacy regulations. This includes carefully managing employee access to public GenAI tools that may store input information indefinitely.

- Enhance model risk management: Update model identification criteria and risk assessment frameworks to account for the unique characteristics of GenAI models. This includes developing methods to evaluate and mitigate potential biases in model outputs.

- Foster a culture of responsible AI use: Educate employees about the risks and benefits of GenAI, providing clear guidelines on its appropriate use within the organization. This can help mitigate the risks associated with unauthorized or inappropriate use of AI tools.

- Collaborate with regulators: Stay informed about evolving regulations related to AI and GenAI in the financial sector. Engage proactively with regulators to ensure compliance and contribute to the development of industry best practices.

By implementing these strategies and considerations, financial institutions can harness the power of GenAI to transform their risk and compliance functions while effectively managing the associated risks. This balanced approach will enable banks to realize the full potential of GenAI while maintaining trust and regulatory compliance in an ever-evolving technological landscape.

Taking Care of Risk and Compliance

The transformation of banking through Generative AI follows a systematic workflow that prioritizes both innovation and risk management. The process begins with Data Input & Processing, where banking data is collected, cleaned, and validated to ensure quality input for AI systems. This feeds into the GenAI Implementation phase, where artificial intelligence models are applied to various banking operations, such as customer service, fraud detection, and financial analysis. Each AI output then undergoes a critical Risk Assessment stage, where potential risks are evaluated and categorized. High-risk decisions are channeled through a mandatory Compliance Review process, ensuring alignment with regulatory requirements and industry standards. Once approved (or if initially deemed low-risk), the AI-driven solutions are integrated into Banking Operations, where they enhance customer service, automate processes, and support decision-making. The final stage, Monitoring & Audit, maintains continuous oversight of the entire system Creating a feedback loop that returns to the initial data input stage. This cyclical process ensures ongoing improvement, risk mitigation, and regulatory compliance while maximizing the benefits of Generative AI in banking transformation.

Conclusion

The integration of Generative AI in banking risk and compliance is causing a revolution in the financial sector. This technology has a significant impact on how banks manage risks, ensure regulatory compliance, and streamline their operations. GenAI’s ability to analyze vast amounts of data, identify patterns, and provide real-time insights makes it an essential tool in today’s ever-changing banking landscape. By harnessing the power of GenAI, financial institutions can boost their risk assessment capabilities and gain a competitive edge.

To make the most of GenAI, banks need to prioritize use cases, develop a comprehensive ecosystem, and manage associated risks effectively. This means focusing on high-value opportunities, building a strong infrastructure, and putting safeguards in place to address concerns about data security and privacy. As GenAI continues to evolve, its role in banking risk and compliance will only grow more important. Financial institutions that embrace this technology. And use it responsibly will be better equipped to navigate the complex regulatory environment and stay ahead of emerging risks in the dynamic world of banking.